Welcome to Dallas Habitat’s Homeownership Counseling Program.

Buying a house for the first time can seem tedious and overwhelming, especially when it comes to financing. What does your debt-to-income ratio look like? Do you have enough money saved for additional costs?

At Dallas Habitat, you’ll work one-on-one with a HUD-certified Counselor to become mortgage-ready. We’ll guide you through income, credit, debit, savings, and more to lay the foundation for buying your first home.

Welcome to Dallas Habitat’s Homeownership Counseling Program.

Buying a house for the first time can seem tedious and overwhelming, especially when it comes to financing. What does your debt-to-income ratio look like? Do you have enough money saved for additional costs? Are you able to identify your needs vs. wants? At Dallas Habitat, you’ll work with a HUD-certified Dallas Habitat Homeownership Counselor who will help you navigate the process and become mortgage-ready. Our team will prepare you for success in your home buying experience by providing one-on-one conversation regarding income, credit scores, debt-to-income ratio and building savings. These conversations and steps will help to lay the groundwork for purchasing your first home!

Dallas Habitat's Homeownership Counseling Program

Take the First Step Toward Homeownership with our Pre-Screen Tool

Once you’ve met the initial eligibility criteria through the pre-screen process, you’ll be invited to complete our online intake application.

If you don’t meet the eligibility criteria at this stage, don’t worry—we still encourage you to continue your financial journey with us by attending our free webinars at dallasareahabitat.org/habitat-classes.

A quick reminder: you can only submit your responses once. Please double-check everything before submitting. Any additional submissions won’t be accepted.

Also, note that being approved through the pre-screen process does not guarantee eligibility to purchase a home, but it’s an important first step on the path to homeownership.

If you have questions during the process, please contact us at homeownersupport@dallas-habitat.org.

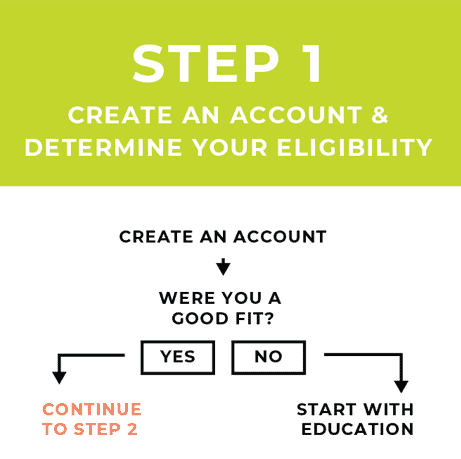

How it works:

STEP 1

In this step, you’ll create an account for our Homebuyer Community – your personalized homebuying portal. In the community, you can browse workshops, pre-screen yourself for our program and if you’re eligible, you’ll even complete your application right there.

To start the process today, click on the button below and create your account.

STEP 2

If you’re a good fit for our program, you’ll apply and then begin one-on-one homeownership counseling and our pre-purchase education. In this phase, you’ll build savings, reduce debt and work towards mortgage-readiness.

STEP 3

In this step, you’ll get pre-approvals and start searching for your new home! This might mean buying a Habitat home, or buying a home in the open market. Either way, we’re here to help you cross the finish line!.

STEP-BY-STEP-PROCESS

FAQ’S

Buying a house for the first time can seem tedious and overwhelming, especially when it comes to financing. What does your debt-to-income ratio look like? Do you have enough money saved for additional costs? Are you able to identify your needs vs. wants?

At Dallas Habitat, you’ll work with a HUD-certified Homeownership Counselor who will help you navigate the process and become mortgage-ready.

What should I expect from the Dallas Area Habitat HUD-certified Homeownership Counseling program?

Our homeownership counseling program is designed to assist you in becoming mortgage ready in one year or less. From our program, you can expect one-on-one counseling where we create a path together to help you achieve your goal of homeownership.

What is the Dallas Habitat Homeownership program?

I’m interested in the Dallas Habitat Homeownership program! How do I get started?

In order to purchase a Dallas Habitat home, you’ll start by completing Homeownership Counseling with Dallas Habitat and become mortgage-ready.

What are the income and credit requirements for the homeownership counseling program?

As part of your goals in the counseling program you’ll be required to work towards achieving a credit score of 620 or above, demonstrate sufficient and stable income to purchase a home based on the current housing market, and have adequate savings to cover expenses related to a home purchase. Please note: If you are currently participating in a debt management program, we advise you to wait until you complete the program before applying for homeownership counseling, as your credit score, history and debt will impact your ability to qualify for a mortgage.

Is there a cost for the program?

Yes, the program cost for a single applicant is $125 and dual applicants is $200. This provides unlimited one-on-one counseling sessions with a HUD-certified counselor, credit reviews, and also includes the cost of all classes and workshops.

My spouse is no longer living with me or is incarcerated. Do they have to complete the application and be on the mortgage with me?

Texas is a community property state, therefore, your spouse should be included in your counseling application and should you choose to buy a Habitat house, they will also be included on the mortgage, unless you are legally divorced.

Can I apply if I am not a US citizen?

To be eligible for our programs, you must be a U.S. citizen or legal permanent resident.

Can I choose where I want to live? Can I choose my house and where it would be built?

I’m ready to take the first step! How do I start?

We’re excited that you’re taking the first step towards homeownership and that you’ve selected the Dallas Habitat Counseling program to assist you! The first step is to create an account, and then complete our pre-screen tool. This tool allows you to determine your eligibility to apply for our Counseling program, where we can assist you in becoming mortgage ready within a year. Note: The pre-screen tool is NOT our program application.

How long after I complete and submit the Pre-Screen will I get a response?

I submitted the pre-screen tool and it stated I am not a good fit for the counseling program at this time, what do I do? We encourage you to browse the resources available and attend our in- person workshops and online financial education modules through Pocketwise CAFÉ.You can access all of education resources when you log into the Homebuyer Community.

I submitted a Homeownership Counseling application and would like to know what my status is.

I’m having an issue with the online application and would like to speak to someone.

If you experience issues with the online application through the community, send us an email to homeownersupport@dallas-habitat.org with your first and last name and the best way that we can reach you. You will hear from us within 48 business hours.

What do I do while I wait to hear from my Dallas Habitat Homeownership Counselor?

We’re excited that you are eager to start your homeownership journey! Since education is a requirement for the counseling program, we highly suggest that you get started as soon as possible with our online and in-person education opportunities. Sign up today in the Dallas Habitat Homebuyer Community!Sign up today in the Homebuyer Community!

Las clases también se ofrecen en español.

Haga clic aquí para ver

I don’t have access to a computer. How do I submit an application or complete online education?

Both the application and online education are mobile friendly, but if you need access to a computer, you are more than welcome to stop by the office to use our computers located in our office lobby Tuesday– Thursday, 9 am – 4:30 pm.

Please change to Tuesday- Thursday from 9am-4:00pm.